what is fit tax on paycheck

The rate is not the same for every taxpayer. FIT stands for federal income tax.

Calculating Federal Income Tax Withholding Youtube

So InTiCa Systems has an ROCE of 29.

. However they dont include all taxes related to payroll. If youre one of the lucky few to earn. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37.

As a business owner you are responsible for withholding the federal income tax from. FICA taxes are commonly called the payroll tax. What is fit on my paycheck.

Herein what is fit on my paystub. Fit stands for Federal Income Tax Withheld. The percentage method is based on the graduated federal tax rates 0 10 12 22 24 32 35 and 37 for individuals.

All individuals and companies who do business in the US. In absolute terms thats a low return and it also under-performs the Electronic industry average of 84. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

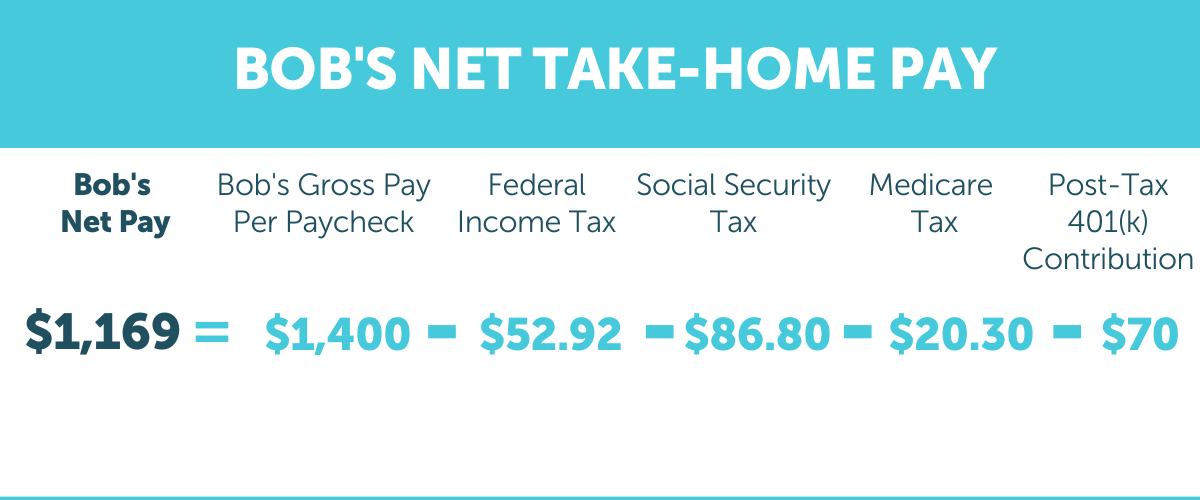

The federal income tax rates remain unchanged for the 2020 and 2021 tax years. FIT is the amount required by law for employers to withhold from wages to pay taxes. How Your Paycheck Works.

What percentage is fit tax. Your income tax rate is dependent on the amount of taxable income you earn because federal income tax is built on a progressive tax system. The FIT deduction on your paycheck represents the.

10 12 22 24 32 35 and 37. 37 for incomes over 518400 for individuals. Your net income gets.

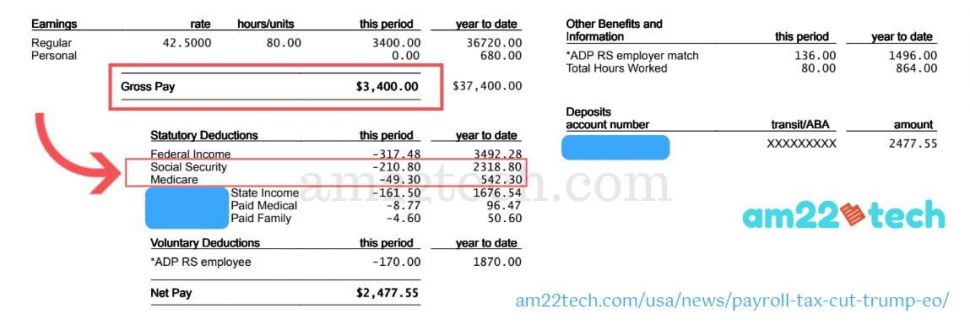

FICA taxes consist of Social Security and Medicare taxes. Another 7 percent or 70 a week goes to pay benefits for federal retirees and. Chicken shortage august 2022 Fiction Writing.

Key takeaways FIT taxes are the income taxes that you pay to the federal government. The employee is responsible for this. The percentage method is based on the.

Your employer uses the data in your IRS filing sheet to determine how much of. The federal government is entitled to a portion of your income. Thus this employee more than likely would have the additional 9 percent Medicare tax withheld in December.

The federal income tax rates remain unchanged for the 2020 and 2021 tax years. How Does FICA Impact Self-Employed Workers. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

If you see the fit deduction listed on your paychecks earning statement it is an acronym for federal income tax. The rate is not the same for every taxpayer. Federal Income Tax or FIT is the amount withheld from an employees paycheck which goes toward their Federal Income Tax liability at the end of the year.

If you earn at least. 10 12 22 24 32 35 and 37. How Much You Can Expect To Come Out Of Your Paycheck In Federal Income Taxes Depends On Your Age Filing Status.

Overview of What Is FIT Tax FIT tax refers to Federal Income Tax On every paycheck employers have the obligation to withhold and remit to the government the federal. What is the fit tax rate for 2020. What is fit deduction on my paycheck.

This amount is based on information provided. What is the fit tax rate for 2020. But calculating your weekly take.

FIT is applied to taxpayers for all of their taxable income during the year. One of the primary benefits to. If youre an employee your employer probably withholds income tax from your paycheck and pays it to the IRS in your name.

4 rows Is fit the same as federal withholding. In the above chart we have. Are subject to certain taxes.

Taxable Wage Definition For Social Security Taxes

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

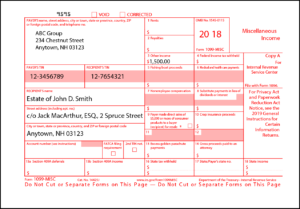

Processing The Final Paycheck For A Deceased Employee Checkmatehcm

How To Read A Paycheck Or Pay Stub

Understanding Your Paycheck Credit Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Payroll Tax Cut Trump Order Should H1b L1 Use It Am22tech

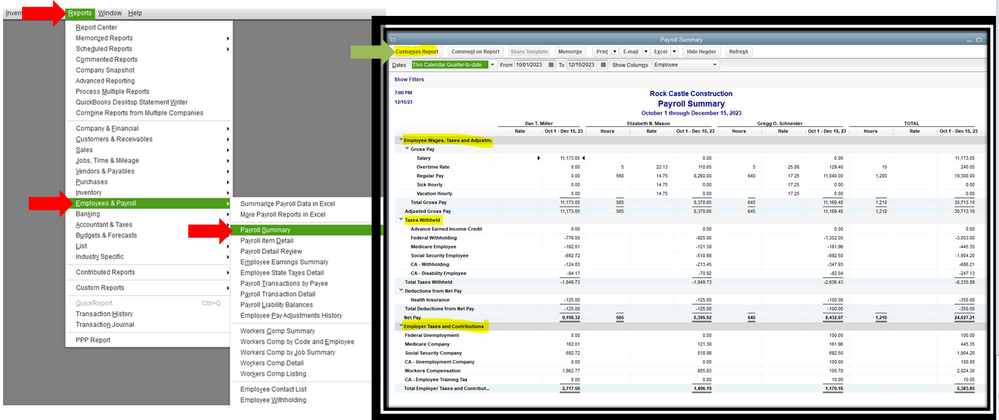

Solved Federal Taxes Not Deducted Correctly

What Are Employer Taxes And Employee Taxes Gusto

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Amid The Coronavirus Pandemic U S Chamber Of Commerce

How To Calculate Payroll Taxes Methods Examples More

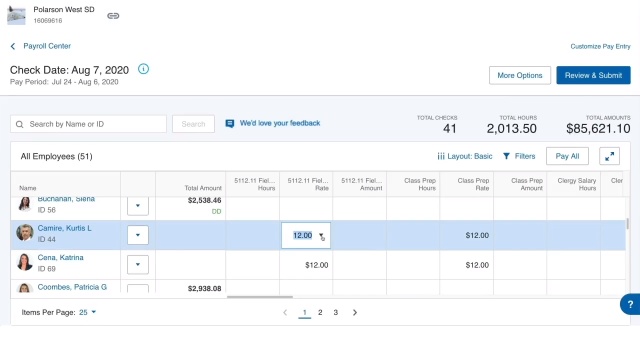

Payroll Services Online Payroll Software Paychex

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

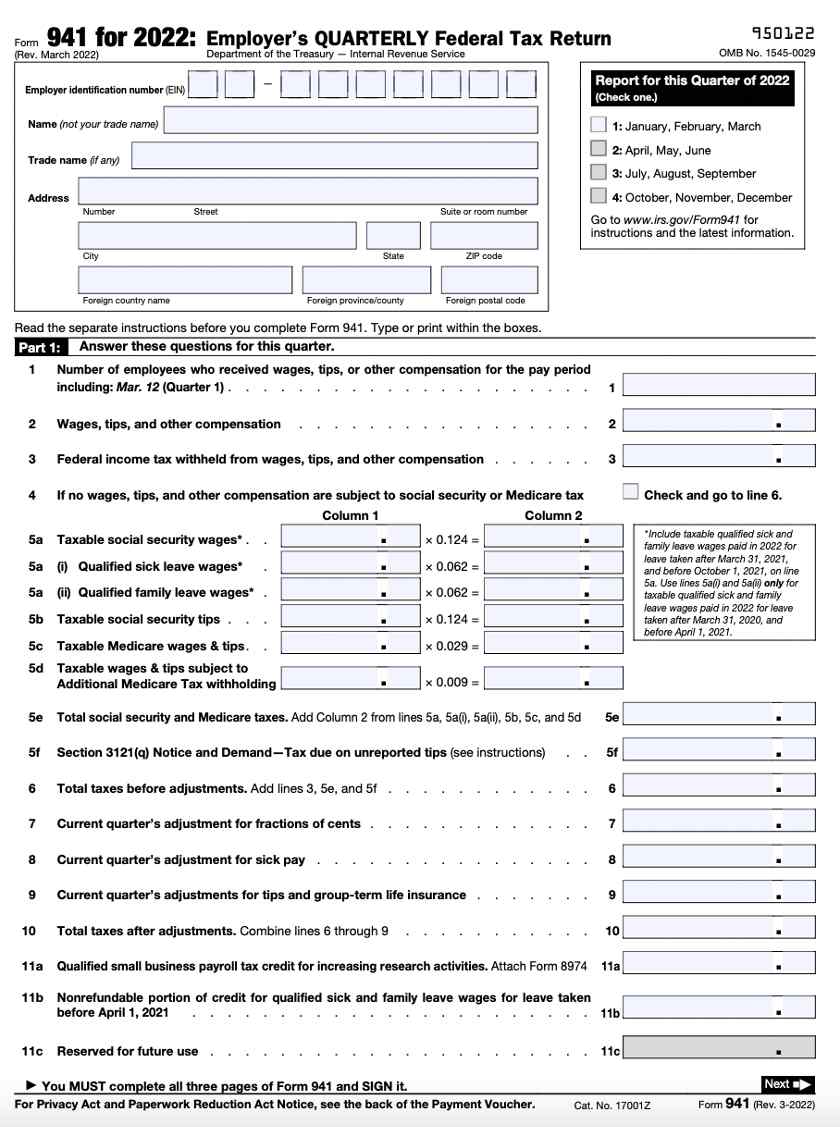

12 Payroll Forms Employers Need

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Free Online Paycheck Calculator Calculate Take Home Pay 2022