what is suta tax texas

To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate. How Unemployment Changes by State.

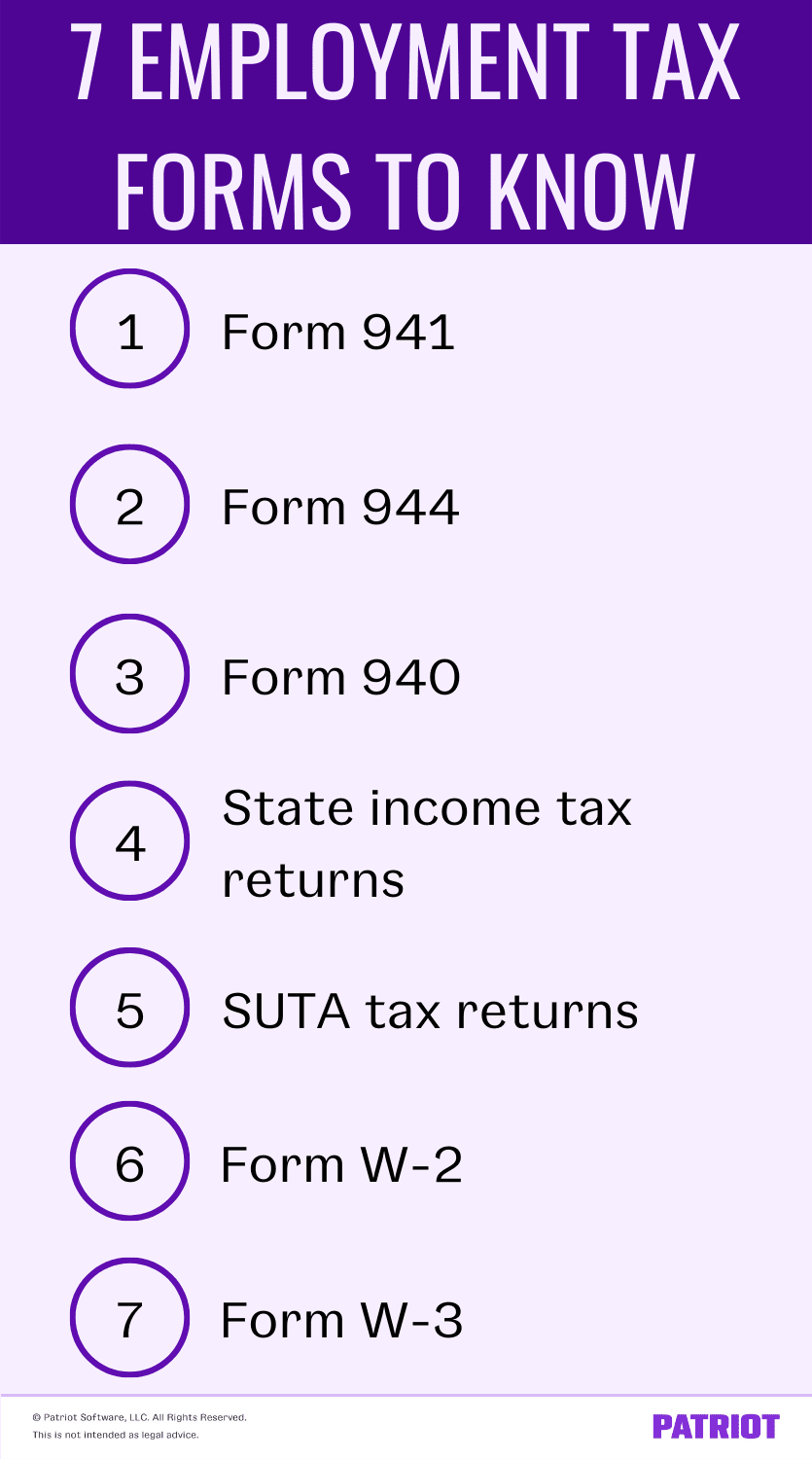

Employment Tax Returns Forms Due Dates More

The only difference between paying federal and state income taxes will be the forms you need to file.

. Guaranteed compatible with IRS and SSA regulations. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base. The crisis led to.

Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the experience rating systemSUTA dumping compromises experience rating systems by eliminating the incentive for employers to keep employees working and to return unemployment benefit claimants to work. Select your preferred chapter. Lupus Foundation of America.

As such a business with many previous employees who have filed unemployment claims will tend to have a higher rate than a business that has none. Specifically the following states have no individual income tax or tax only certain types of investment income. Calculates federal income tax withholding FIT state income tax SIT local income tax state unemployment tax SUTA state disability insurance SDI and federal unemployment tax FUTA.

Employers pay a certain tax rate usually between 1 and 8 on the taxable earnings of employees. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. For example in Michigan the taxes are due on the 25th of the month instead of the end of the month.

Employers who pay employees in OK must register with the OK Tax Commission OTC for a Withholding Account Number and register with the OK Employment Security Commission OESC for a State Unemployment Tax SUTA Account NumberOK also requires employers to register their payroll provider with the OTC and the OESC as an authorized third. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. Squares online payroll service handles your federal and state tax filings and payments on your behalf at no additional charge.

The maximum amount of taxable wages per employee per calendar year is set by statute and is currently 9000. Works with our W2 1099 software major tax payroll 1099 preparation software products. Once these forms are filed with the appropriate agencies you can download save and print each document by going to Staff Payroll Tax Forms in Square Dashboard.

A charitable organization with 501c3 tax-exempt status. April 25 July 25 Oct. The Great Recession was a global economic downturn that devastated world financial markets as well as the banking and real estate industries.

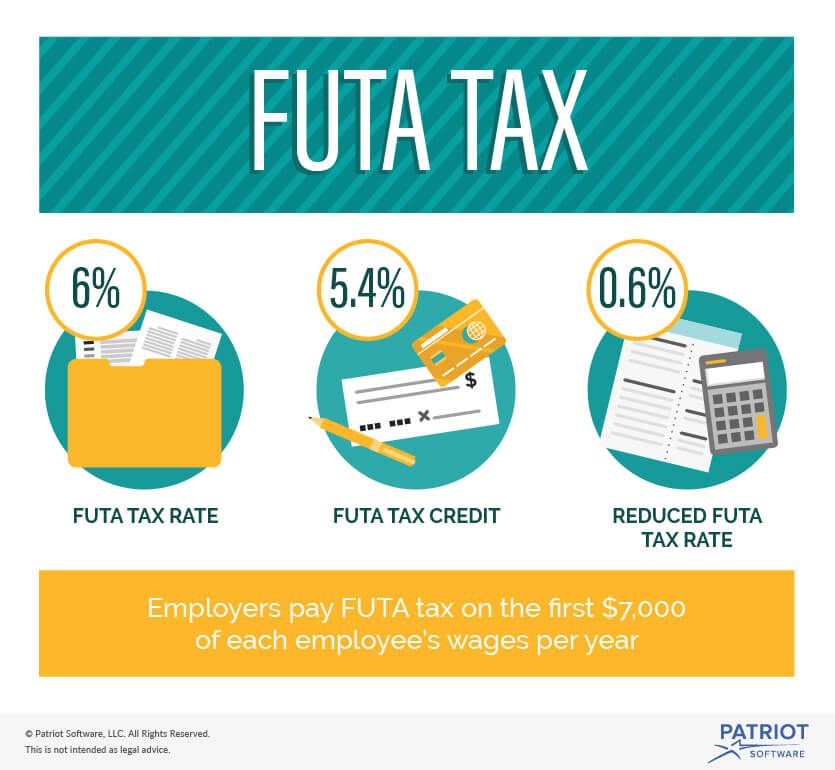

The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA wage base of 7000 per employee although most states wage bases exceed the required amount. States use funds from SUTA tax to pay unemployment benefits to. Illinois Withholding Income Tax Generic Report and Export to CSV file.

Contribution from the employers side may vary depending on the benefit opportunities provided. We answer your questions and help you get the job done. The UI tax funds unemployment compensation programs for eligible employees.

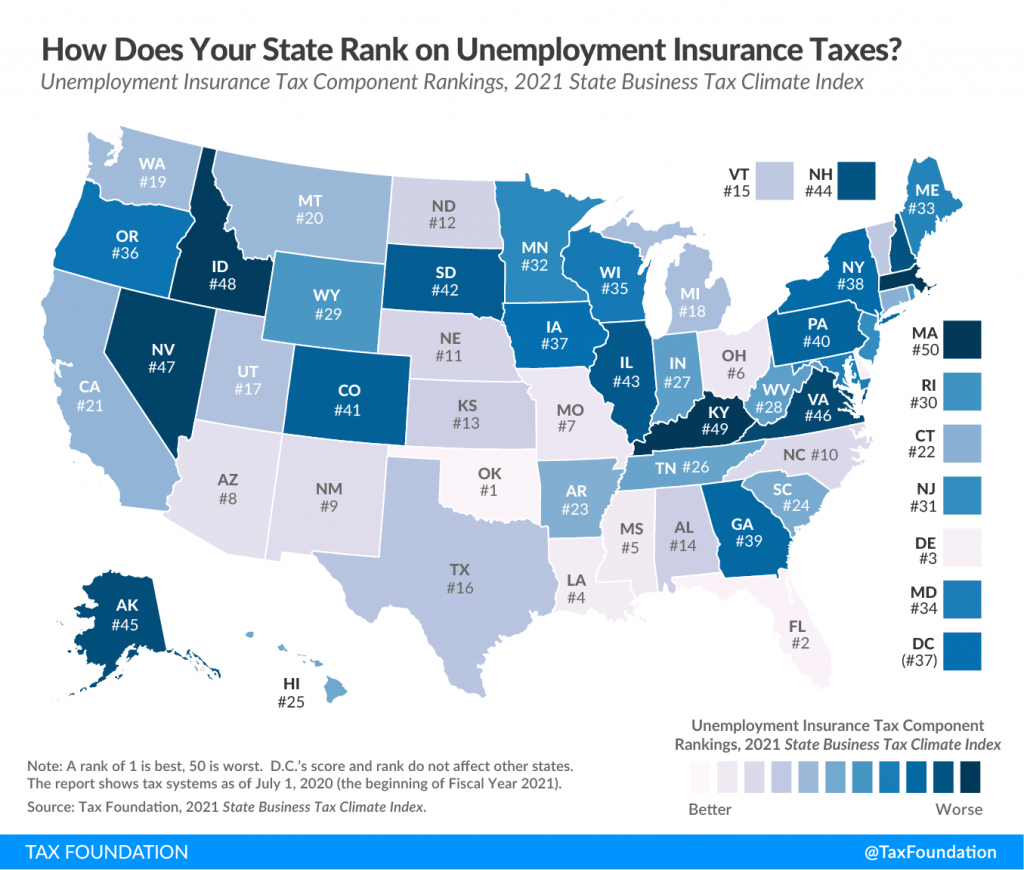

The money contribution for benefits by an employer or an employee is also needed to be itemised on a pay stub. State unemployment insurance taxes are based on a percentage of the taxable wages an employer pays. While the Federal Unemployment Tax Act FUTA must be paid regardless of where youre located it shouldnt come as a surprise that each state also has its own State Unemployment Tax SUTA rules and regulations.

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Contribution from the employees side may include payment of FUTA tax SUTA tax FICA tax 401k etc. Depositing and filing payroll tax.

In Indiana state UI tax is just one of several taxes that employers must pay. In most states that ranges from the first 10000 to 15000 an employee earns in a calendar year. Neglecting to pay SUTA or SUI taxes can result in.

State income tax is paid in all states except Florida Texas Alaska Nevada Wyoming South Dakota and Washington state. Taxable Wage Bases 2019 2022. Each claim assessed to an employers account can result in a tax rate.

The State Unemployment Tax Act SUTA tax is much more complex. Other state and local payroll tax rates differ by location. For tax years 2021 2020 2019 and before.

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. Check out this list of state income tax rates that The Balance posted in January 2022. In addition to FUTA employers typically must pay taxes to fund the states unemployment program or SUTA.

Failing to meet the deadline may result in a penalty or late tax payment interest assessment. Federal income tax is paid solely by employees to maintain the country. State unemployment tax rates typically vary based on an employers previous claims history.

Top 10 reason to choose our Tax Forms and Supplies. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. There are multiple chapters near you.

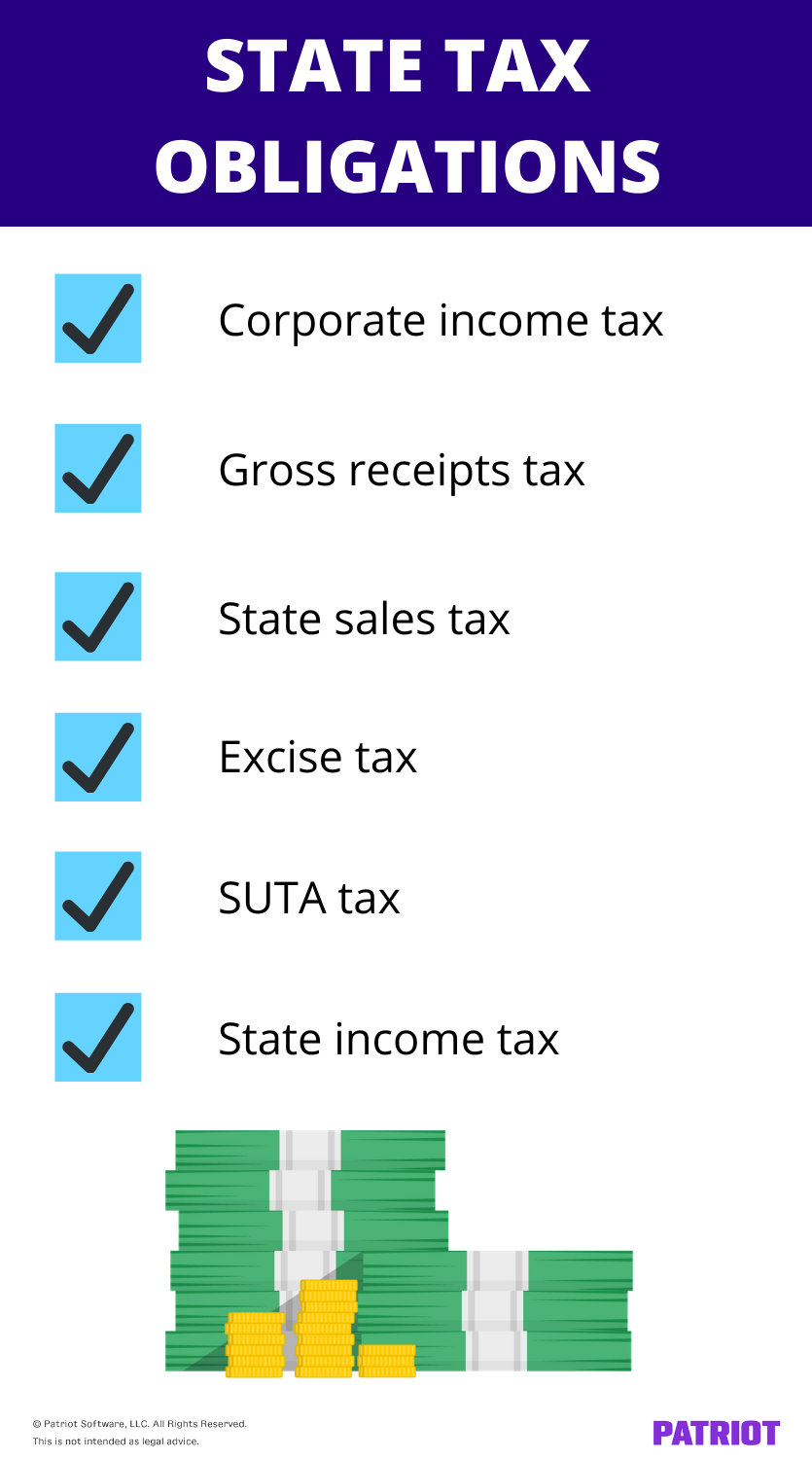

Some states like California and Texas require LLCs to pay a special business taxThis tax is usually called a franchise tax but can also be a business excise tax or a privilege taxThis tax can either act as a yearly fee with a flat amount or it can be a percentage. Serving north central and west Texas including DallasFort Worth San Antonio Austin El Paso Lubbock and surrounding areas. Local taxes vary and are generally used to fund education and community improvement projects.

Things to know about employer taxes as a manager. NYS-45 on Paper New York. Criminal charges to the employer.

However SUTA tax due dates vary by state. Team members both W-2 employees and 1099 contractors are also provided with. Different states have different rules and rates for UI taxes.

While the Federal Unemployment Tax is only paid by the employer some states require additional money to be withheld from an employees wages in addition to the amounts contributed by the employer for SUTA. Texas Unemployment Insurance Paperless Filing.

What Is Sui State Unemployment Insurance Tax Ask Gusto

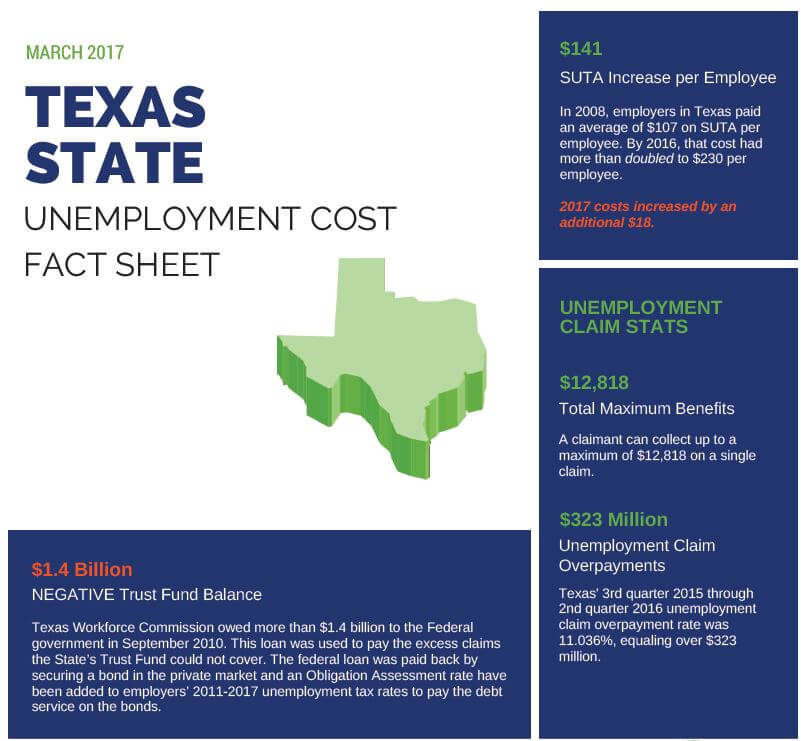

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

2022 Federal Payroll Tax Rates Abacus Payroll

How To Fill Out Irs Form 940 Futa Tax Return Youtube

Sui Sit Employment Taxes Explained Emptech Com

Business State Tax Obligations 6 Types Of State Taxes

Calculating Futa And Suta Youtube

Sui Sit Employment Taxes Explained Emptech Com

Futa Tax Overview How It Works How To Calculate

Suta State Unemployment Taxable Wage Bases Aps Payroll

Suta Tax Your Questions Answered Bench Accounting

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Fast Unemployment Cost Facts For Texas First Nonprofit Companies

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Breaking Down The Federal Unemployment Tax Act What Is It